First-Time Homebuyers

You’ve worked hard to get to a point where you are ready to buy a home. Now let us help.

Our team has worked with many first-time homebuyers, and we understand that every buyer’s situation is different; with that said, we are well versed in guiding you through the various steps of the mortgage process.

Know your complete budget

When determining your home budget, it’s important to consider your income, debt and expenses. When calculating home cost, most consider principal, interest, taxes and insurance. It’s also important t however, to include all of your expenses, such as utilities, cost of commuting, association fees, etc. You can call utility companies and ask for estimates connected to your future home. Once you have a complete list of all your potential expenses, you’ll have a better idea of what you can afford. You can try living for a few months on a “simulated mortgage payment” to make sure you can afford the housing budget you’re considering.

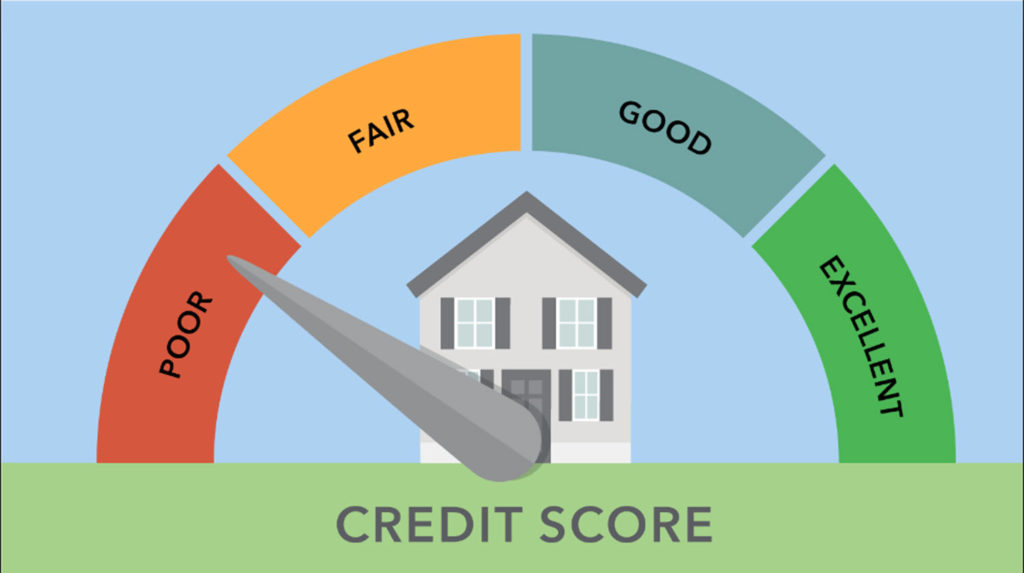

Know your credit score.

After deciding to buy a home, you should get a copy of your credit report to make sure that you are not being unfairly penalized for erroneous, old or settled debts. It is also not a good idea to apply for new credit prior to applying for financing or before you have closed on your home. Typically, the higher your credit score, the lower your down payment and qualifying interest rate; and consequently monthly payments will be. For instance, buyers with credit scores below 650 will most likely need to pay a higher down payment than those with scores above 700 – those buyers see much better deals and rates.

Get pre-approved for your home mortgage.

Before putting in the long hours house hunting, if you want to buy a home, it is advisable to get pre-approved. It eliminates the guess work regarding what you can afford. You will need to provide your lender with documentation and verification of income and assets (e.g. pay stubs, W-2s, tax returns, recent bank statements, your credit report, etc.) so they can determine how much to lend and represent on your pre-approval letter. While not a commitment of how much financing you have secured, a pre-approval letter helps to expedite the underwriting and loan process. Some sellers will only accept offers from buyers with a full pre-approval letter.

Know the housing market that you’re considering.

In recent years, the housing market has experienced many ups and downs with sales & interest rates. When buying a home, it’s probably prudent to be familiar with the current market conditions and how they will affect your home purchase price. Working with a realtor who has a solid understanding of the housing market to help negotiate your home purchase is a wise idea. Don’t buy a home unless you plan to stay in the home for a few years at least.

When looking to buy a home, the general rule is that you should plan to be in the same location for at least five years. If you move prior to five years, you most likely will lose money on your purchase. Between closing costs and the monthly mortgage payments, which are structured so that you pay more interest in the first few years that you own the home; it is best to identify a home where you want to remain for at least five years, thereby paying down the principal of your mortgage.

Look for a home in a good school district.

Excellent schools establish that an area is a good location in which to live. Even if you don’t have kids, homes located in good school districts are generally more expensive, but worth the investment since they tend to appreciate or hold their value, which will be beneficial when considering resale. Houses in school districts that are highly rated are more and in-demand than those in sub-par school districts. Even in a down market, home prices in great school districts fair better than those in districts that are not rated highly.

Work with professionals

Most real estate transactions require the involvement of more than two dozen professionals; mortgage brokers, real estate agents, underwriters, insurance assessors, attorneys and inspectors, all play vital roles in your home-buying process. Each professional has a specific role in educating, advocating and executing for you during your purchase process. Select carefully and work closely with your team.

Don’t skip the home inspection!

A home purchase likely is the single largest investment you’ll make in your lifetime, and a home inspection is well worth the extra cost to ensure that there are no hidden problems in your home. When conducting a walk-thru, you only can see what is visible to you. A good home inspector can see beyond what is visible. Unlike your car, there is no “check engine” light for some potential major repair problems in a home. Home inspectors physically inspect the property from the roof to the foundation. They examine the condition of the roof, plumbing, heating and cooling system and provide their findings in a written report within a few days after the inspection. Your realtor can contact the seller with the information listed on the report for repairs or renegotiate the sale price. A good realtor will most likely have a list of and can recommend reputable home inspectors.

Don’t sign documents unless you read and understand

To buy a home, the process includes an enormous amount of paperwork; but it is advisable to take time to read and truly understand what you are signing. Don’t be afraid to ask questions if a document does not make sense, or seems inaccurate. Particularly at closing, it will take some time for you to review documents. Your realtor can be helpful in preparing you for the numerous documents you’ll encounter.